Does a Delaware LLC Have to Pay California Taxes?

|

Getting your Trinity Audio player ready...

|

Looking to form a California LLC? Learn more here.

- Why forming in Delaware instead of California is better for business.

- The only ship that doesn’t float is a partnership. Don’t put your personal assets at risk.

- What are Delaware LLC taxes?

- Will your Delaware LLC have to pay taxes to both California AND Delaware?

- What is the “Delaware Loophole” and why will it save my business money?

“Dear IncNow,

Does a Delaware LLC have to pay California taxes? I am choosing whether to register my LLC in California (where I am a resident) or Delaware. Aside from the benefit of the one-time filing fee being less in Delaware, what are other LLC tax implications? Will I need to pay tax in California? If so, how will it be structured? Can I write off losses too? Does the rate depend on the “home state” of my company? If it doesn’t, is there any advantage in forming the LLC in Delaware rather than in my state of residence?”

Dear Customer,

The choice about where to form has less to do with minimizing taxes and more to do with protecting the owner from liability. If you live in California, you will pay California taxes on the Delaware LLC’s income. No other state, not even Nevada, will relieve you of your obligation to pay taxes on company income.

Should I Form an LLC in California or Delaware?

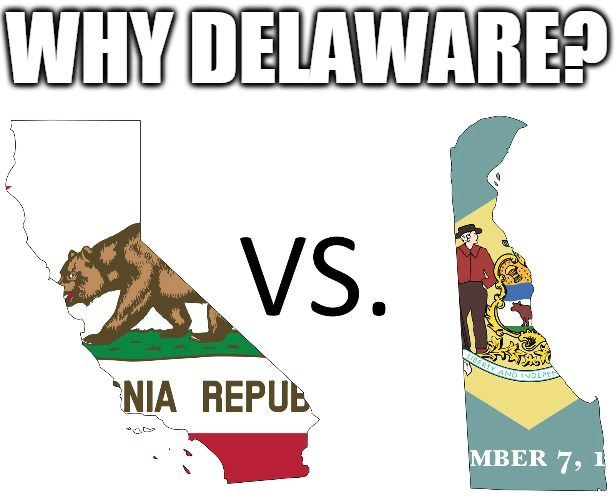

Many people choose Delaware over California due to the favorable and consistent reputation of Delaware courts and judges. Compare this to the very unpredictable decisions that come out of California. California Courts are not known for business decisions. It would not be wise to leave the fate of your business in these hands.

There are several glaring problems in the California LLC Act, which even its drafters acknowledge. The most significant is where members have the “freedom of contract” to agree to what they want, but with major exceptions. In particular, anything “manifestly unreasonable” can be determined to be void. On the surface this seems innocuous, but it enables California Courts to consider almost anything causing a dispute or inequity among members, in hindsight, “manifestly unreasonable.” Business owners of a California LLC has no assurances that California Courts will respect your Agreement. The Delaware LLC Act has no such exception. In contrast, Delaware Courts will respect your Operating Agreement and not second guess you.

Forming an LLC in Delaware is Better for Business

Since the California LLC law will not be favorable to your company, you should form it in Delaware. Delaware is the “gold standard.”

Delaware has the most pro-business laws of any state. See this infographic on why you should chose Delaware as your incorporation state.

When Do You Need to File a Certificate of Authority

When you incorporate in Delaware, will you need to file a Certificate of Authority to “qualify” for authority to do business in California? This depends on your activities there. Generally, if you have a brick and mortar office, employees, licensing, or property in the state outside the formation state than you need to qualify it in your “home” state or state of operation. The types of activities which do not require qualification in another state involve simply selling products or services in a state without employees or an office there does not usually require qualification. Each state has its own laws on whether your company’s level of activity is great enough to have to go on record. You can find information about what types of activities require qualification and on that state’s official Division of Corporations website.

MORE: What You Need to Know About Delaware Foreign Qualification

The “Delaware Loophole”: No Sales Tax

Delaware has no sales tax. Unlike most states, Delaware has no intangible personal property tax, which many call the “Delaware loophole”. No Delaware income tax has to be paid or filed, and a business license is not required if the LLC does not do business in Delaware. You will still need to pay taxes where you transact business.

How Hard Is It to Pay the Delaware LLC Tax?

Staying current on your Delaware franchise tax bill is very simple. The fee is due on June 1 each year for LLCs and it is a flat $300 each year. It can be paid at the division of corporations website or through www.defrantax.com.

MORE: Here’s How to Determine Your Principal Place of Business